Payroll Outsourcing in Jordan

Jordanian Dinar (JOD)

English

أيام العمل

Sunday to Thursday

ساعات الدوام

48 ساعة أسبوعيًا

أنواع عقود الموظفين

Definite & Indefinite

فترة الاختبار

90 Days

دورة استحقاق الرواتب

شهريًا

ضريبة الأجور

0% -20%

5% - 30%

Hire and pay employees across the globe

- Ensure compliance with local regulations.

- Save more money on payroll operations

- Keep your sensitive data secure

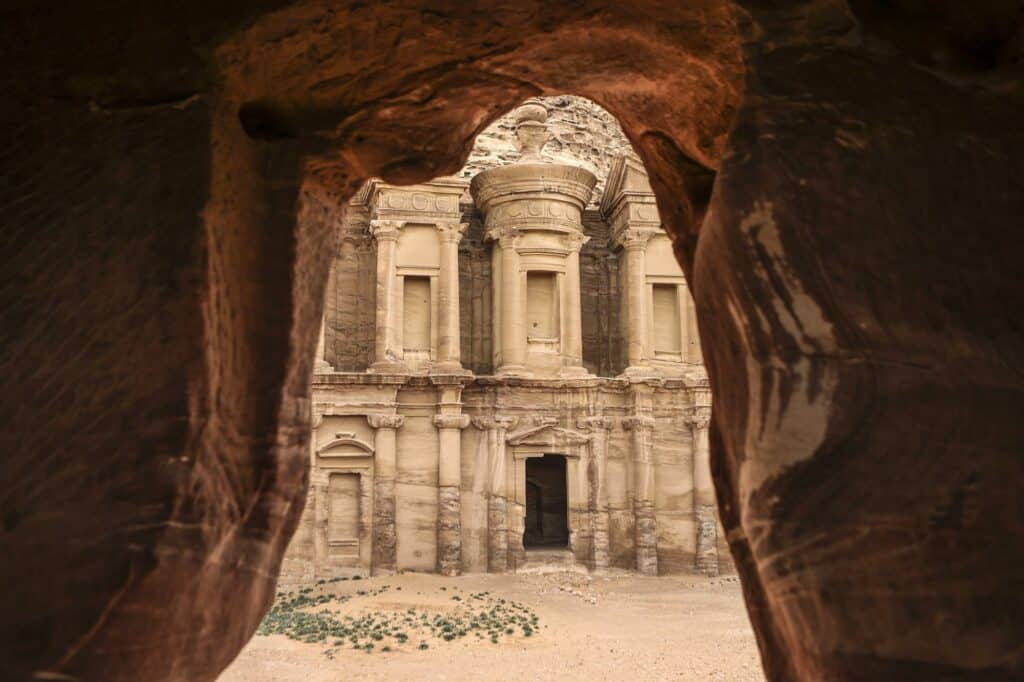

Plant Your Business Roots In Jordan

Jordan offers the perfect environment for international expansion thanks to its stable economy, friendly business landscape, and strategic location. The country rests in the heart of the Middle East, acting as a trade and commerce. By planting your operations in Jordan’s soil, you will gain access to the European, Asian, and African markets. What’s more, the government in Jordan has established various reforms over the years to promote entrepreneurship in the country. This makes it even easier for companies, especially small businesses, to get started.

If there is one challenge to expanding to Jordan, it is managing payroll. Payroll processing involves calculating employee salaries, deducting the applicable taxes, and ensuring payroll compliance. While this may sound easy, it is time-consuming and would cost you more money to build your in-house payroll team.

An easier way to get around this challenge is to outsource your payroll to payroll outsourcing companies in Jordan. Payroll companies in Jordan have extensive expertise in the country’s regulations and tax laws. This way, they can help you remain compliant and ensure accuracy in payroll processing. Oftentimes, they also offer customized payroll processing services, saving you time and resources.

If you’re looking for a reliable outsourced payroll solution in Jordan, let Edge be your partner.

Integrated Payroll Services For Business Success

At Edge, we understand the importance of efficient HR and payroll services. Our expert-handled payroll outsourcing services in Jordan will take the burden of payroll functions off your shoulders so you can focus on what you do best–improving your core business functions.

Maintain Regulatory Compliance

Our payroll professionals have in-depth knowledge of Jordan’s payroll taxes, labor practices, and payroll function regulations. We consistently stay on top of any changes in legislation to help you ensure compliance.

Customized Outsourced Payroll Solution

We understand that every business is unique. Hence, we try to tailor our outsourced payroll functions to suit your business needs. Whether you are looking for cost savings or outsourced payroll efficiency, we can help.

Accurate Payments Every Time

Through our advanced payroll outsourcing model, we ensure all your employees are paid accurately on time. You can trust us with handling all aspects of payroll management, including benefits administration and tax compliance.

Data Security At It’s Best

We prioritize the security of your payroll data. All your sensitive data is stored safely on our payroll software, and we have protocols in place to prevent unauthorized access to your employee data.

Streamlined Process For Improved Efficiency

When you outsource payroll processes to us, we’ll make sure that it is streamlined and carried out on time. Our experts will take care of all tasks without payroll errors, freeing up your time to focus on your business core function.

Dedicated Support 24/7

Whether you have concerns about the payroll process or need help with HR services, we are available round the clock to help you and guide you. Just write to us or call us, and our payroll experts will be at your assistance.

Experience Cost-Effective Global Payroll Processing With Edge

With us as your payroll service company in Jordan, you can cut down significantly on upfront costs and resources. Through our competitively priced payroll outsourcing services, you will gain exceptional value and enjoy seamless business growth. Contact us today, and we will handle all the complexities of processing payroll so you can focus on achieving your strategic objectives.

The Payroll System In Jordan

دورة استحقاق الرواتب

The payroll frequency in Jordan is usually monthly, meaning employers calculate the employee wages every once a month. However, some companies choose to pay their employees on a bi-weekly or semi-monthly basis. In such cases, the employers will work with payroll services in Jordan to issue payslips and transfer salaries twice a month.

Once the salaries are calculated without payroll errors, they should be processed to employees’ bank accounts on the designated payment date. This date should be clearly communicated to all employees in advance to ensure transparency and avoid any confusion. Failure to do so can lead to unnecessary problems down the lane.

If you find it hard to manage payroll processes, it would be better to work with payroll & bookkeeping services in Jordan. Being experienced in payroll outsourcing work, they will help you get all payroll-related tasks right every month.

Overtime

Overtime in Jordan refers to the additional hours worked by employees beyond their regular working hours, which is 48 hours a week.

The overtime rate varies depending on whether it’s regular overtime, night shift overtime, or weekend/public holiday overtime. For regular overtime during weekdays, employees are typically entitled to 125% of their regular hourly wage for each hour worked beyond the standard workday. This means that if an employee’s regular hourly wage is $10, they would earn $12.50 per hour for overtime work during weekdays.

For holiday overtime, employees are entitled to 150% of their regular hourly wage for each hour worked.

Minimum Wage

The minimum wage is the lowest amount of money an employer in Jordan can legally pay their employees. The minimum wage is generally decided by the government based on factors like living expenses and economic conditions.

Currently, the minimum wage in Jordan is JD 220/ month. This means that employers must pay their staff at least this amount every month. It is worth remembering that this rate can vary based on the industry and job responsibilities.

In addition, the government will periodically review and adjust the minimum wage. So, it’s essential that you stay informed about any updates to ensure compliance with the law. Payroll outsourcing in Jordan will take this responsibility from your shoulders as the service provider will handle all the regulatory tasks.

Annual Leave

The annual leave entitlement in Jordan depends on how long an employee has served in a company. Employees who have worked continuously for at least one year are entitled to 14 days of paid leave per annum. For employees with more than five years of service, the annual leave entitlement increases to 21 days.

Employees can accrue their annual leave and take it all together after discussing it with the employer. Any accrued leave cannot be carried over to the next calendar year. However, this is subject to the employer’s discretion and any relevant company policies.

Parental Leave

Mothers can get up to 10 weeks of maternity leave, including both before and after childbirth. During this time, employees are entitled to receive 100% of their average daily wage. After returning from maternity leave, female employees can take one hour’s leave during a workday to nurse their baby.

When it comes to paternal leave, male employees are granted 3 days paid leave from work after childbirth.

Employers in Jordan must comply with regulations regarding parental leave without discrimination. Sometimes, documentation might be necessary for employees to prove their eligibility for parental leave, such as providing a birth certificate or adoption papers.

To learn more about leave provision, consider talking to a bookkeeping and payroll services provider in Jordan. If you already work with outsourcing companies, they will take care of the procedures associated with employee absence.

Sick Leave

The rates and rules for sick leave in Jordan are decided by the country’s labor laws. Generally, employees are entitled to 14 days of sick leave per year, provided they have completed their probationary period. The exact number of sick leaves an employee can take will vary depending on how long they have been in service.

Under Jordanian law, employees are entitled to full pay during the sick leave period. For extended periods of sick leave, the employees should submit a medical certificate from a certified healthcare professional.

If you’re establishing your business operations in Jordan, you must familiarize yourself with the sick leave regulations. Alternatively, you can work with a payroll outsourcing company that will then handle all these procedures. Payroll outsourcing companies will typically keep accurate records of employees’ sick leaves and process payroll accurately every month.

Severance & Termination

You can terminate an employee’s contract due to performance issues, restructuring, or other reasons. A severance pay is typically required when dismissing an employee for no particular reason. The amount of severance pay will depend on the length of the employee’s service and the reason for termination. Generally, employees are entitled to one month’s salary for each year of service, up to a maximum of 3 months’ salary.

However, there are specific situations where severance pay may not be required, such as termination due to serious misconduct or violation of employment terms by the employee.

Additionally, employers are generally required to provide written notice to employees prior to termination, with the duration of the notice period depending on the length of the employee’s service.

Hire the right way

Let our team handle all of the compliance and payroll on your behalf

Frequently Asked Questions

What are the employee benefits to keep while one process payroll in Jordan?

There are quite a few aspects to keep in mind when doing corporate payroll services in Jordan. This includes annual leaves, sick leaves, maternity leaves, paternity leaves, and other special leaves. All of these vary based on how long an employee has served in a company. So, it is important to be careful when calculating wages and income taxes.

If you don’t already have an outsourced payroll provider, consider outsourcing payroll to a trusted third-party company. They will run payroll and handle all aspects of human resources, from helping you avoid non-compliance to saving more money. This can be a great option to ensure quality assurance. If you’re looking for payroll outsourcing companies in Jordan, contact us at Edge, and let’s discuss how much does it cost to outsource payroll.

What do Edge’s outsource payroll services include?

As a trusted service provider, we handle all aspects of payroll outsourcing. This includes calculating employee salaries, withholding deductions, filing taxes to respective tax authorities, and paying your employees. By outsourcing your payroll to us, you can enjoy compliance and more freedom to focus on your core business, like most companies that run successfully in Jordan.

To learn more about our outsourced payroll services, contact us today!

What are the 3 stages of payroll outsourcing?

At Edge, our bookkeeping and payroll services include three main phases. The first is data collection, where we, as your payroll outsourcing provider, will collect the data required to handle the services rendered successfully. In the second phase of outsourcing payroll, we calculate employee wages, and in the final stage, we transfer payments to employee bank accounts.

As an experienced payroll outsourcing provider, we have a proven track record of helping businesses succeed. So, if you need direct access to Jordan and are looking for payroll outsourcing companies, get in touch with our expert payroll outsourcing providers at Edge.